RICS HomeBuyer Report

Booking for - June 6, 2025*

*Subject to surveyor availability

You should choose an RICS HomeBuyers Report if you would like more extensive information when buying a conventional house, flat or bungalow, which is built from common building materials and is in reasonable condition, and you would like information and advice on construction, condition and repairs.

An RICS HomeBuyers Report will cost more than some other types of survey, such as an RICS Condition Report, but it will give you more detail on the state and condition of the property, which you’ll find of great value when assessing if it’s the right property for you.

*Subject to access of the property which may be conditional on the current owner and viewing arrangements.

Let us provide you with one of our detailed RICS HomeBuyer Reports.

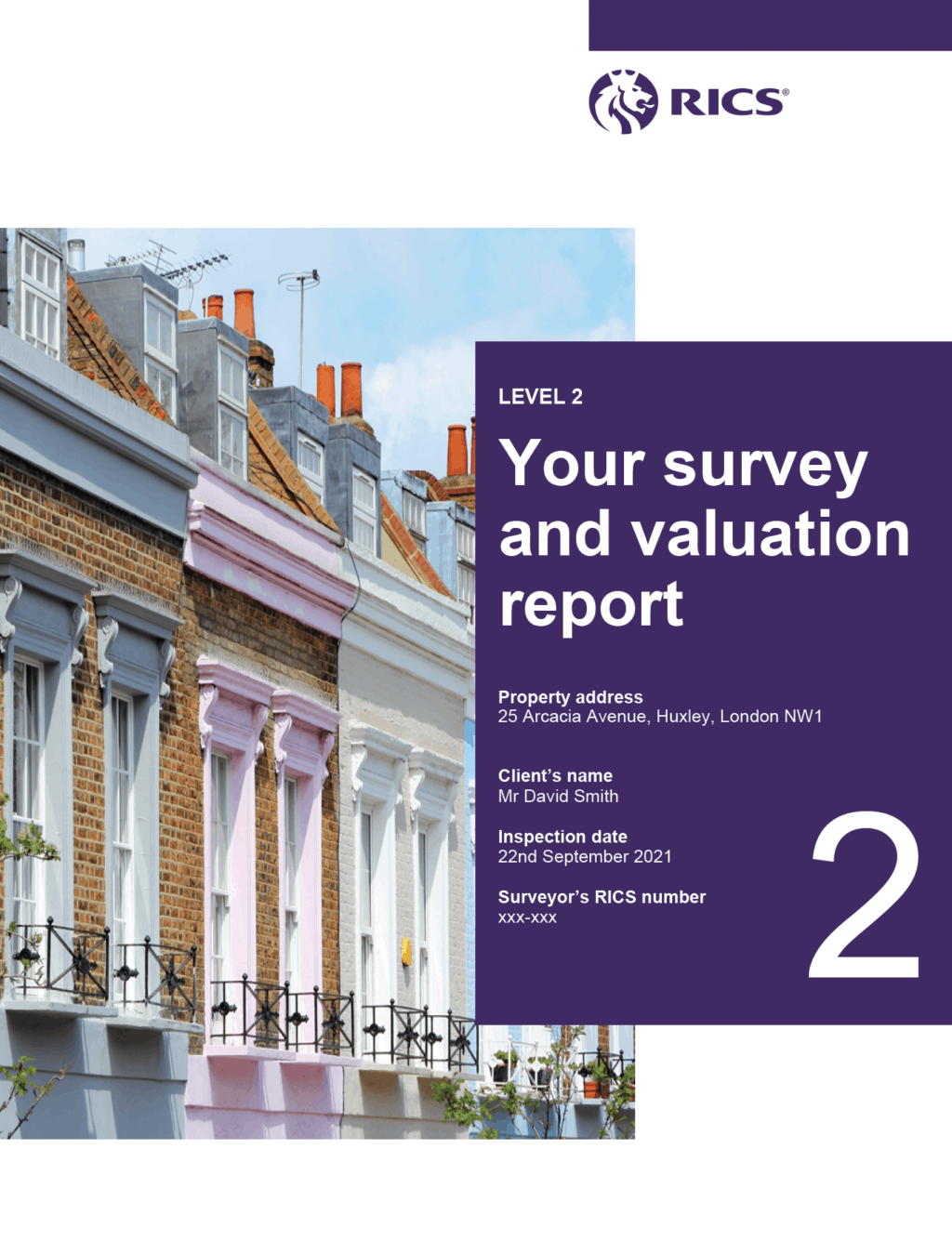

Example RICS HomeBuyers Report

Our RICS Surveyors will help you choose the correct service and ensure that a report that meets your needs is delivered quickly and efficiently. we pride ourselves on providing quality products and services to our customers and maintaining our well-earned, excellent reputation.

If you’re unsure which type of survey is right for you, you can speak to one of our RICS Surveyors members to help you make the right decision. If you already know which service you want to go ahead with, just let us know and we’ll begin making the arrangements.

We’ll use our knowledge to select the right RICS surveyors for you. We’ll handle the process on your behalf and help you deal with any queries you may have.

*Valuations are an additional £50 on booking.

Please call 03300 587 127 or contact us if you have any questions*.

RICS HomeBuyers Report Benefits

Here are 6 of our RICS HomeBuyers Report favourites:

- An extensive inspection of the property by a RICS qualified surveyor

- A professional 50+ page report, example here (size varies upon findings)

- A list of problems that the surveyor considers may affect the value of the property

- An RICS HomeBuyers Report lists advice on repairs and ongoing maintenance

- Legal issues that should be addressed by your conveyancer

- Issues that need to be investigated to prevent serious damage or dangerous conditions

RICS HomeBuyers Reports, A Surveyors Perspective

There is a huge difference between a mortgage survey (often called a report on valuation) and an RICS HomeBuyers Report. The first is on behalf of the lender to check the value of your new home and the latter to check its condition.

A fact that you can't ignore is that on average homebuyers spend £5750* on repairs once moved into their new home!

This is often down to not getting a proper survey done before signing on the dotted line. Spending money now can save you thousands further on down the line.Robin Wells BSc (Hons) MA MRICS

Make sure you aren’t left with a unexpected repair bills by appointing FP Surveying to come out and see you. Getting an RICS HomeBuyers Report could be a decision that saves you thousands of pounds.

*Research on behalf of RICS. Actual surveyor may not be as attractive as illustrated.

Remember a valuation is not a survey, ask for an RICS HomeBuyers Report

According to the Royal Institution of Chartered Surveyors (RICS) buyers who didn’t get a survey faced on average £5,750 worth of repairs when they moved in and 17% of these ended up paying more than £12,000 on average to make their homes habitable. Ask yourself, if you can’t afford the price of the survey, can you afford the hefty cost of house repairs down the line?

We understand that when you are buying a new home you want to make every penny count. It might be tempting to assume that a simple mortgage valuation will provide you with the reassurance you need regarding the condition of the property and future maintenance liabilities, but that’s not what it is intended for and you could be faced with significant unplanned repair costs.

Buying a home can be one of the biggest financial commitments you are likely to make so it is important to know as much as you can about the property you are thinking of purchasing.

Ask for an RICS Homebuyers survey cost today.

RICS Level 2 HomeBuyers Reports

Buying a home is probably the biggest investment you ever make, so you’ll want a true picture of its condition right from the start. Mortgage valuations are not the same as house surveys. Lenders conduct basic checks to verify the property’s value, but that’s usually all. A thorough, professional survey identifying any issues early on will save you both time and money.

Our RICS surveyor will have a broad knowledge of your chosen area, types of local property, and issues to look out for. You can trust their detailed assessment to give you confidence by being completely sure of what you’re buying.

During the inspection the surveyor will look over the roof, walls, pipes, timber, and and other visible aspects of the home to check for significant defects. The report is in a standard paper format and uses an easy-to-follow Condition Rating system:

Defects that are serious and/or need to be repaired, replaced or investigated urgently.

Defects that need repairing or replacing but are not considered to be either serious or urgent.

No repair is currently needed

You should choose an RICS Home Survey Level 2 if you are thinking of buying a conventional house, flat or bungalow which was built after 1890 from common building materials and appears to be in reasonable condition, and you would like information and advice on construction, condition and repairs.

The report will provide detail on the condition of the various elements of the property, which you’ll find invaluable when assessing whether or not it’s right for you.

RICS HomeBuyers Library

If you would like more information about RICS HomeBuyers Reports and the RICS, please download the example report and guide to home surveys.

If you have any further questions, please do not hesitate to contact us and we will do our best to answer your questions.